1. The Macro Environment: Velocity vs. Capital Anchors

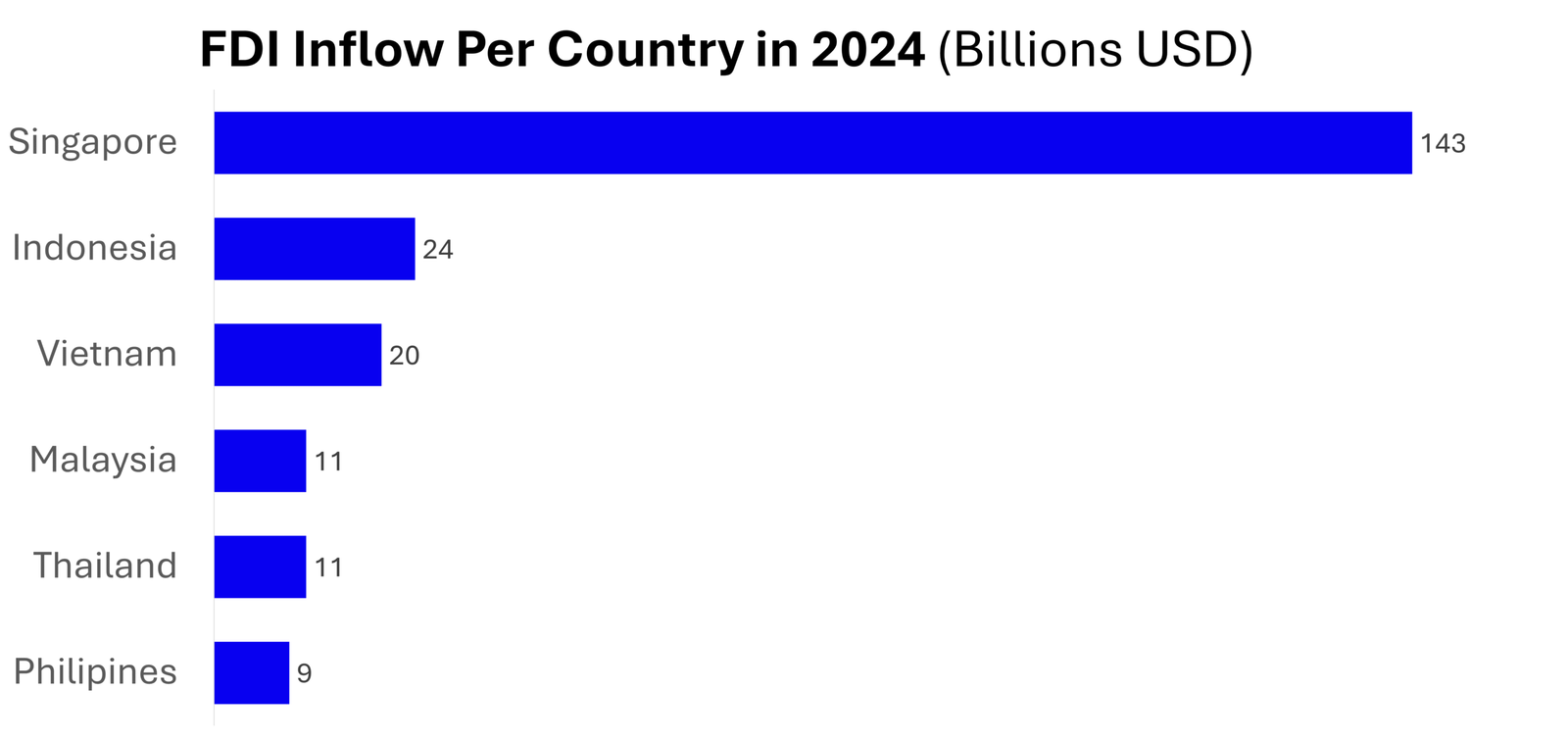

To understand Vietnam’s trajectory, it is essential to first look at the broader ASEAN context. In 2025, Foreign Direct Investment (FDI) flows into the region stabilized, signaling a return of investor confidence. Total FDI inflows surged to 258.69 Billion USD, a robust +14% increase YoY. This rebound occurred despite global investment weakness, reinforcing ASEAN’s position as a leading destination among developing economies.

But the distribution of this capital tells a more nuanced story of specialization.

Singapore continues to retain its status as the primary “capital anchor,” capturing 119 Billion USD in inflows. It acts as the financial gateway, the holding hub where capital is pooled before deployment. In contrast, Vietnam (attracting 33.69 Billion USD) along with Thailand and Indonesia, has cemented its role as the engine of “manufacturing velocity.” Vietnam is where the capital goes to work – building factories, securing supply chains, and driving export output

Source: Trading Economics, 2025; Statista, 2025

The “Mid–Market” Shift

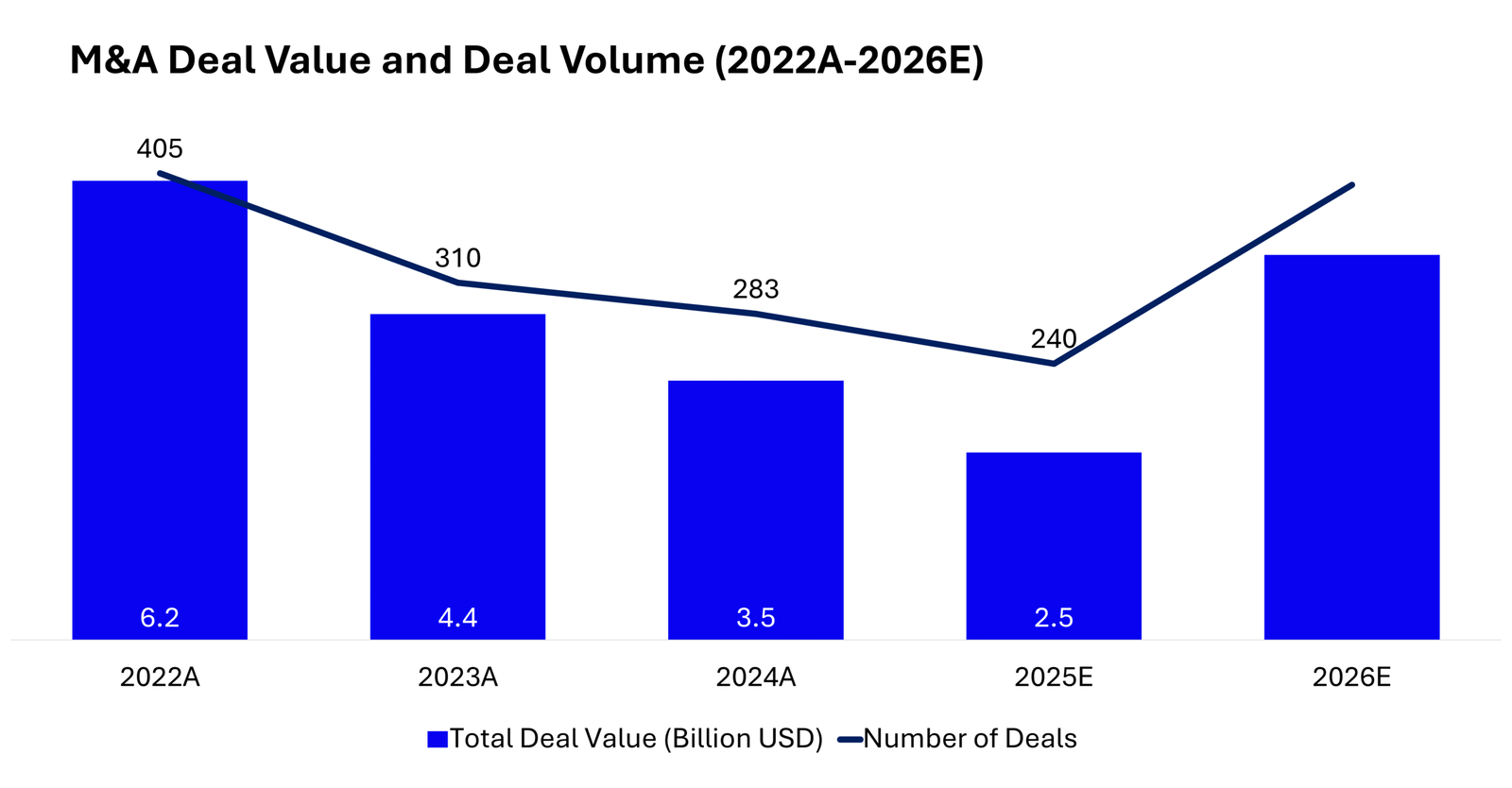

Perhaps the most telling statistic for 2025 is not the volume of capital, but the structure of the deals. While total deal value remains healthy, the average transaction size in ASEAN declined sharply by 44%, falling from 60.13 Million USD in 2024 to just 33.9 Million USD in 2025.

Why the sudden drop?

DealFlow.sg analysis suggests this is not a sign of weakness, but a strategic transition. The market is shifting away from massive, headline-grabbing “mega-mergers” toward selective, mid-sized transactions. Investors are becoming more cautious, facing tighter financing conditions, and are thus prioritizing strategic, “bite-sized” acquisitions that offer easier integration and clearer exit paths. This trend toward mid-market consolidation is creating a specific type of opportunity for agile investors – one that requires less capital but significantly more operational expertise.

The full Vietnam Outlook 2026 report breaks down this mid-market trend by sector, analyzing the specific consolidation strategies and “Clean Deal” structures that are enabling foreign investors to unlock value in this competitive landscape.

2. The ASEAN Growth Engine: Three Pillars of Expansion

To understand Vietnam’s opportunity, it is necessary to examine the neighborhood. ASEAN has emerged as a major growth engine within the Asia-Pacific, maintaining average GDP growth above 5% and supporting an economic base of nearly 700 million people.

Source: Data World Bank, 2025

The report identifies three structural drivers reinforcing ASEAN’s position as a global center of gravity:

2.1. Supply Chain Relocation

The region’s strategic position between the Pacific and Indian Oceans makes it the natural beneficiary of global diversification. ASEAN is no longer just a “China Plus One” option; it is a primary production hub. The region’s aggregate GDP is following a clear upward trajectory (2010–2025), driven by this industrial migration.

2.2. Resilient Consumer Growth

Domestic consumption now represents around 60% of ASEAN’s GDP. Household expenditure is projected to increase consistently through 2030, supported by rising incomes and urbanization. This internal demand protects the region from external trade volatility.

2.3. Digitalization as a Core Enabler

The digital economy is reshaping productivity. With $120B+ in private digital investment (2016–2025) and over 200 million new internet users, technology is scaling the region’s economic transformation.

3. The “Strategic Reset” in Vietnam

3.1. Real Estate & Manufacturing

For the past two years, the Vietnamese real estate market was paralyzed by legal ambiguity and a liquidity crunch. 2026 marks the end of this paralysis and the beginning of the “Strategic Reset.”

The 2025 Revised Land Law: Unlocking Liquidity

The single most significant catalyst for this reset is the enforcement of the 2025 Revised Land Law. For foreign investors, this is the “green light” the market has been waiting for. By resolving critical ambiguities regarding land usage rights, asset valuation, and clearance compensation, the new law effectively creates a market for “Clean Deals” – assets with clear legal status that can be acquired without the toxic legacy risks of the past.

This regulatory clarity is already reshaping capital flows. Manufacturing remains the bedrock of the economy, driving a significant rise in industrial production. With average monthly manufacturing wages lower than Thailand and Malaysia, Vietnam retains its critical cost leadership.

Source: Accilime, 2025

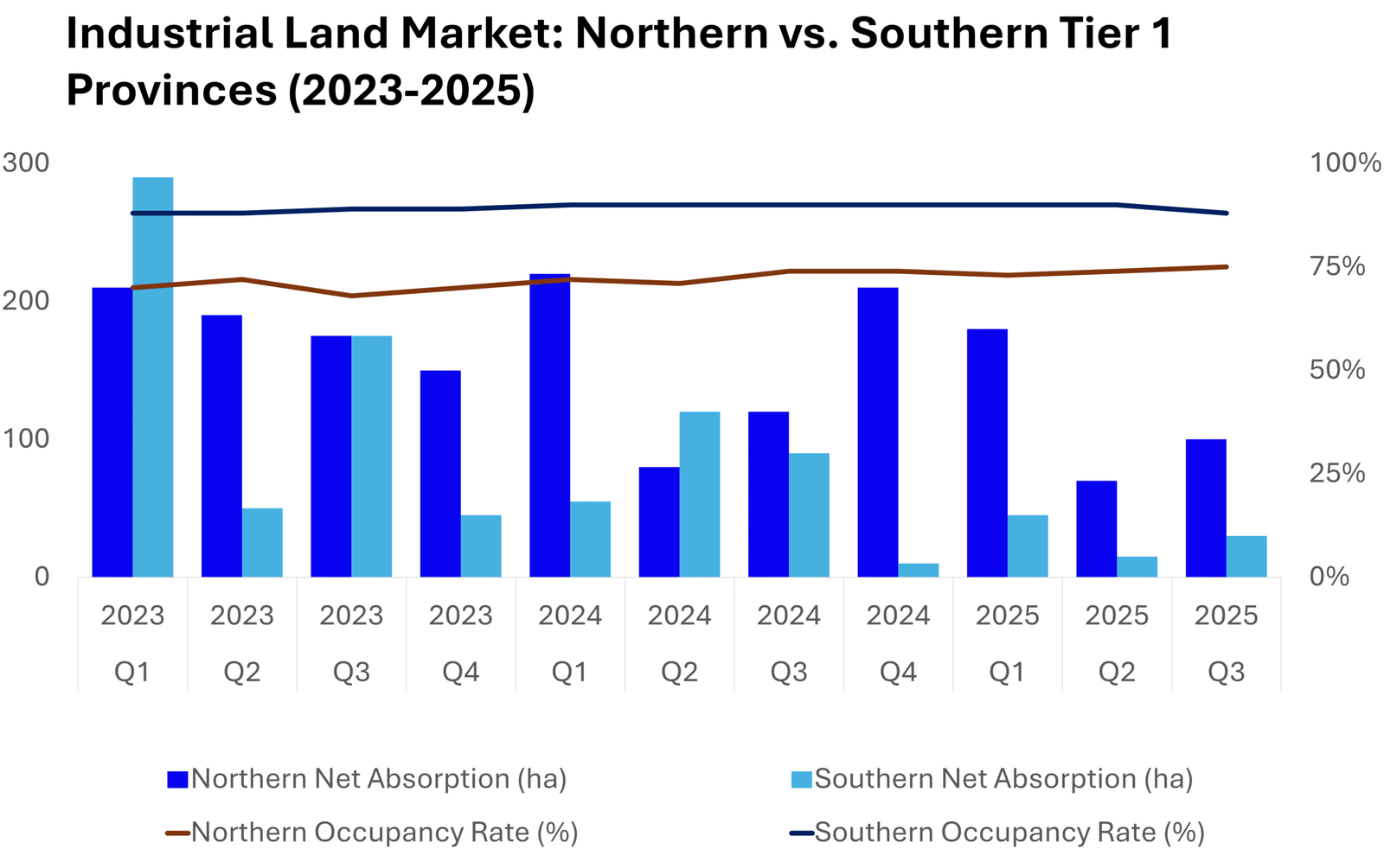

The “China Plus One” Maturation: The Pivot to Tier 2

However, the “China Plus One” strategy is no longer just about moving to Vietnam; it is about where capital is allocated within Vietnam.

Tier 1 industrial hubs in the North (like Bac Ninh and Hai Phong) and the South (like Binh Duong) are approaching saturation. Land prices in these core areas have escalated, and labor markets are tightening. Consequently, the market is witnessing a massive capital migration toward Tier 2 Frontier Provinces. Smart capital is now bypassing the saturated hubs to secure large land banks in emerging provinces that offer untapped labor pools and, crucially, aggressive fiscal incentives that core provinces can no longer match.

Source: CBRE, 2025

While general market reports list the usual suspects, the full report identifies the specific Tier 2 provinces that have seen a massive spike in inquiries in 2026. These provinces are currently offering tax holidays and land rent reductions that significantly outperform the national average.

3.2. Consumer

The narrative of the Vietnamese consumer is evolving from “access” to “quality.” However, this transition is happening against a backdrop of short-term caution.

The “Value Optimization” Paradox

Household expenditure is projected to rise consistently through 2030. The number of affluent households (earning >$45,000 USD) is set to expand rapidly by 2028, while the emerging middle class (earning >$10,000 USD) will surge significantly. This creates a massive “graduation” effect, where millions of consumers enter the discretionary spending class.

Yet, in 2025, over a third of Vietnamese consumers reported feeling “financially strained.” This has created a behavior termed “Value Optimization.” Consumers are trading down on essentials to save money, creating a disconnect between rising purchasing power and actual ticket sizes in traditional retail.

Source: Euromonitor, 2025

The “Experience Pivot” is not uniform. The Vietnam Outlook 2026 breaks down the detailed income bracket projections (2026-2028) that drive this trend, identifying exactly when the “affluent” demographic will reach critical mass to support premium retail expansion.

The “Experience Pivot”

Expenditure is shifting decisively to the Experience Economy – travel, dining, and digital services. This shift is underpinned by the digital economy. With massive private digital investment over the last decade and a digitally native population, Vietnam’s e-commerce Gross Merchandise Value (GMV) is projected to nearly triple by 2030 from 2024 levels.

Source: KPMG, 2025

3.3. Cold Chain & Logistic

For investors seeking yield in 2026, it is necessary to look beyond general warehousing.

The general logistics sector is facing a crisis of success. With over 80 active players and a massive influx of supply over the last three years, the market for standard “dry” warehousing is experiencing severe saturation. Vacancy rates are rising, and operators are being forced into a “race to the bottom” on price to secure tenancy.

However, a massive structural opportunity exists in the Cold Chain sector.

Despite Vietnam’s booming export economy (seafood, agriculture) and modern retail expansion, the cold chain infrastructure is woefully underdeveloped.

- Market Size: Remains in a nascent stage, projected to expand at a double-digit CAGR through 2028.

- The Gap: The market is served by a highly fragmented and limited number of professional providers relative to the population size.

- Capacity: Cold storage facility density remains critically low nationwide, creating an immediate supply-demand imbalance.

This acute supply deficit creates a “Structural Yield Gap.” Investors who deploy capital into high-tech frozen logistics and temperature-controlled infrastructure can capture significant rental premiums compared to general warehousing.

Furthermore, the “Instant Delivery” economy is driving demand for tech-enabled micro-hubs within city centers. Developers are actively repurposing underutilized urban assets – basements of old commercial buildings, defunct factories – into high-density sorting centers to solve the “last mile” efficiency puzzle.

Identifying optimal locations is critical. The full report identifies three key sectors where they are in most demand in the booming instant delivery market.

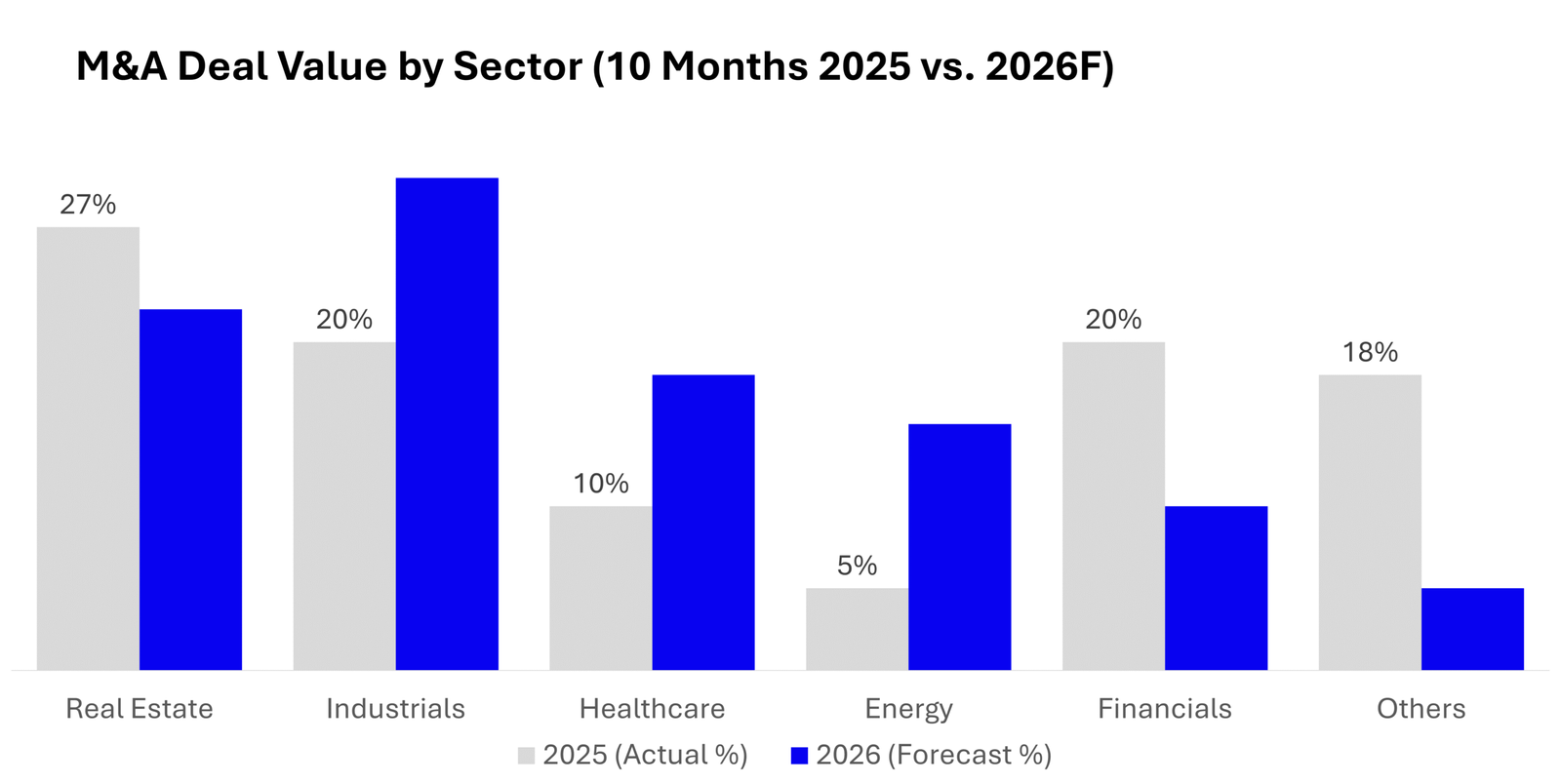

4. The 2026 M&A Playbook: The Pre–Upgrade Alpha

The year 2026 will be defined by the FTSE Russell Emerging Market Upgrade.

Anticipated to occur in September 2026, this upgrade will reclassify Vietnam from a “Frontier Market” to a “Secondary Emerging Market.” This is not just a label change; it is a liquidity event. It will trigger billions of dollars in passive capital inflows from ETFs and index funds that are mandated to hold Emerging Market assets.

From Distressed Scavenging to Structural Growth

Anticipating this influx, domestic conglomerates are currently racing to “sanitize” their balance sheets. They are divesting non-core assets, clearing bad debts, and improving governance to attract this new wave of foreign capital. This drives the shift from “Distressed Scavenging” (buying bad assets cheap) to “Structural Growth” (buying good assets at fair value).

Source: DealFlow.sg, 2025

Source: DealFlow.sg, 2025

The “Pre – Upgrade Alpha Strategy”

For foreign investors, the window of opportunity is narrow. Waiting until September 2026 means buying at the top. Smart capital is executing a “Pre-Upgrade Alpha Strategy”: front-loading allocation in H1 2026 to capture asset valuations before the passive capital inflows inflate prices.

But how can downside be protected in a market that still faces “Regulatory Paralysis” and the risk of a “Trump 2.0” trade shock?

The answer lies in Defensive Structuring.

The advisory team at DealFlow.sg has developed a specific deal architecture using Convertible Bonds and Earn-Out structures that immunize capital against administrative delays while preserving upside exposure to the FTSE upgrade.

The Vietnam Outlook 2026 details the exact terms, conversion triggers, and “friend-shoring” JV models that sophisticated investors are using to de-risk their entry. This section includes the “Investor Group Archetype” matrix, which profiles the four types of investors (The Capital Conduit, The Ecosystem Builder, etc.) winning the market today.

Conclusion

The era of the “Wild West” in Vietnam is closing. 2026 is the year of the “Clean Deal” – a market defined by legal clarity, structural growth, and strategic consolidation. The data presented in this article is just the surface. For serious investors, the real value lies in the granular details that allow for precise execution.

The window is before the upgrade—not after. Subscribe to receive the full Vietnam Investment Outlook 2026 and position capital ahead of the FTSE Emerging Market reclassification.

Vietnam Investment Outlook 2026

Final_20251214_DealFlow_VietnamOutlook2026-1-3© 2025 DealFlow.sg. All rights reserved. This content is for informational purposes only and does not constitute financial advice.