Vietnam is redefining its role from a supply chain buffer to a sovereign digital powerhouse. The simultaneous maturation of the data center and semiconductor sectors signals a sharp departure from the cost-competition model. In 2026, smart capital will bypass simple assembly operations to secure the high-value infrastructure underpinning the new digital economy.

The Strategic Reset

The narrative has shifted. Vietnam’s decades-long reliance on textiles is giving way to a future built on silicon and server racks. The government mandate is explicit: the digital economy must capture 50% of GDP by 2045. This is not merely aspirational; it is the structural exit route from the middle-income trap.

The catalyst is the convergence of Data Centers and Semiconductors. These are no longer distinct verticals. They are a symbiotic “Twin Engine.” Data centers are scaling to host sovereign clouds; chipmakers are pivoting from assembly to designing the underlying compute. The capital signal is unmistakable. National champions like Viettel and FPT are executing dual strategies—deploying hyperscale capacity alongside proprietary chip design. With global giants like STT GDC and Amkor committing billions, the market is moving from a passive hedge to a sovereign asset class.

Beyond the “Plus One” Narrative

The primary external force shaping Vietnam’s technology sector remains the “China+1” strategy, which has evolved from a search for cost arbitrage into a mandate for supply chain resilience. This structural shift is evidenced by multi-billion dollar commitments from Amkor and Hana Micron, confirming Vietnam’s role as a critical node for high-value semiconductor packaging. However, domestic regulatory pressure is now equally consequential. Decree 53 has operationalized the concept of data sovereignty, reclassifying user data as a national security asset. This regulation creates a strict “compliance floor,” compelling foreign enterprises to establish local infrastructure to avoid service disruption triggers from the Ministry of Public Security. Consequently, the market is witnessing a forced migration toward “sovereign cloud” architectures, where compliance trumps cost.

To support this infrastructure build-out, the government is utilizing aggressive fiscal engineering to create “Innovation Clusters” in Hoa Lac, Saigon Hi-Tech Park, and Da Nang. Through Decree 10/2024/ND-CP, the state has removed the sector’s most persistent bottleneck—land access—by exempting infrastructure developers from lease fees and clearance costs. This is compounded by a 15-year preferential tax regime that includes a complete exemption for the first four profit-making years, materially boosting project IRR. By subsidizing the co-location of data centers and semiconductor fabs, the government is effectively de-risking the capital-intensive phase of this digital transition.

The Data Center Landscape

The Vietnamese data center market is undergoing a structural metamorphosis. Historically dominated by state-owned telecommunications companies offering basic colocation services, it is now transitioning into a hyperscale-ready market characterized by international joint ventures, high-density computing, and carrier-neutral facilities.

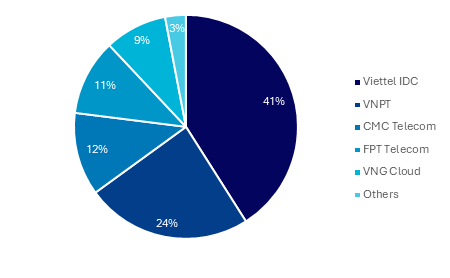

Figure 1: Market share of Vietnam live capacity (CBRE, 2025)

The market is currently moderately consolidated, with the top five domestic players—Viettel, VNPT, CMC Telecom, FPT Telecom, and VNG—controlling approximately 97% of the market share.

The Local Giants (Telcos & Tech Conglomerates)

- Viettel IDC: As the market leader, Viettel is aggressively pivoting toward hyperscale capacity.

- Hoa Lac Data Center: In April 2024, Viettel inaugurated the largest data center in Vietnam in Hoa Lac. With a power capacity of 30MW, 60,000 servers, and 2,400 racks, it is a flagship project designed to be “AI-ready” with high-density cooling capabilities.

- Expansion Pipeline: Viettel has broken ground on a massive 140MW hyperscale campus in Tan Phu Trung (HCMC), targeting full completion by 2030. Their roadmap includes developing a total of 11 large-scale DCs with a combined capacity of over 350MW.

- VNPT: The state-owned post and telecom group focuses heavily on government cloud and national database hosting. It recently opened its eighth data center in Hoa Lac (2,000 racks) and holds a dominant position in the northern market due to its entrenched relationships with ministries and state agencies.

- CMC Telecom: Positioning itself as the “AI Heart” of Vietnam, CMC is a private player with strong international connectivity.

- SHTP Project: The CMC Hyperscale Data Center in Saigon Hi-Tech Park is a $250 million investment. It launched with an initial capacity of 30MW, expandable to 120MW. CMC emphasizes its carrier-neutral status and international certifications to attract foreign enterprise clients.

- FPT Telecom: Part of the FPT tech conglomerate, FPT operates data centers in both Hanoi and HCMC. It is leveraging its software and semiconductor arms to build an integrated ecosystem. FPT is notably part of a consortium proposing a $2 billion AI data center in HCMC, signaling ambitions to move beyond standard colocation.

Foreign Interest and Joint Ventures

Foreign investors are increasingly bypassing the historical reliance on telco-owned facilities by forming Joint Ventures (JVs) or leveraging new regulations to build 100% foreign-owned entities.

- ST Telemedia Global Data Centres (STT GDC): A leading Singaporean operator, STT GDC formed a JV with VNG Corporation (Vietnam’s first unicorn). They operate STT VNG Ho Chi Minh City 1 (9.6MW) and are developing a second facility (STT VNG Ho Chi Minh City 2) with a potential capacity of 60MW, expected to be operational in 2026. This partnership combines STT’s operational expertise with VNG’s local market knowledge and anchor tenant demand.

- Gaw Capital: The private equity firm acquired a greenfield site in SHTP to develop a 20MW carrier-neutral Tier III facility. This project, targeted for completion around 2025, represents a financial investor entering the asset class directly, betting on the long-term appreciation of digital infrastructure assets.

- Alibaba Cloud: In a significant move, Alibaba has announced plans to invest approximately $1 billion to construct a data center in Vietnam. This investment is driven by the need to support its e-commerce ecosystem and comply with local data regulations.

- Telehouse: Operating in partnership with FPT, Telehouse provides Japanese-standard infrastructure in Hanoi, catering primarily to Japanese multinational corporations (MNCs) that require specific operational standards.

| Operator | Ownership | Fleet Size | Capacity (MW) | Utilization Focus | Strategic Archetype |

| Viettel IDC | SOE | 6 DCs | 42 MW | High Volume (6,400+ Racks) | The Market Maker: Sovereign Scale & Security |

| VNPT | SOE | 8 DCs | 25 MW | High Space / Low Density | The National Vault: Gov. Storage & Database |

| CMC Telecom | JV | 3 DCs | 13 MW | Carrier Neutrality | The Connectivity Hub: Finance & MNCs |

| FPT Telecom | Public | 4 DCs | 12 MW | Ecosystem Integration | The AI Factory: Serving Software Exports |

| VNG Cloud | Private | 2 DCs | 10 MW | High-Density Compute | The GPU Node: Gaming & Cloud Native |

Table 1: Vietnam’s Data Centre Summary by Major Players

Escaping the Assembly Trap Through a Strategic Pivot to Integrated Circuit Design and Fabrication

Vietnam’s semiconductor strategy is encapsulated in the formula C = SET + 1 (Chip = Specialized + Electronics + Talent + Vietnam). The government aims to move the industry from its current stronghold in backend assembly to the higher-value frontend of design and eventually fabrication.

Past Status: The “Volume without Value” Paradox

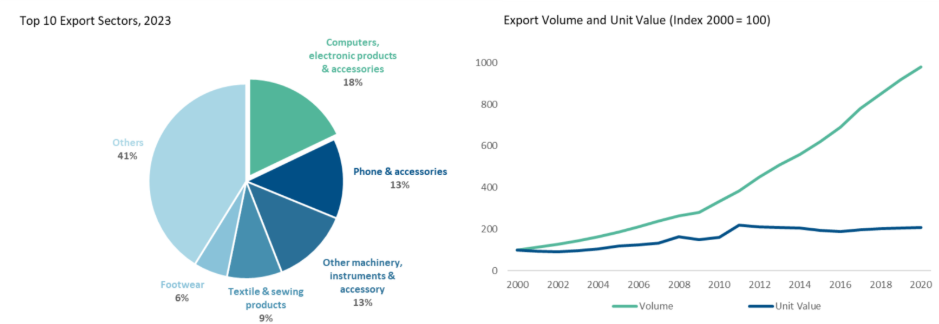

Figure 2: Evidence of the “Assembly Trap” in Vietnam’s Export Economy (Acclime; WorldBank, 2025)

For the past two decades, Vietnam’s integration into the Global Value Chain (GVC) has been driven by a model of “Scale without Substance.” While the country successfully positioned itself as an electronics manufacturing hub, the underlying economic data reveals a critical productivity ceiling. Between 2005 and 2025, while semiconductor export volumes surged nearly tenfold, the average value per unit only doubled. This divergence indicates that growth has been powered by capacity expansion in low-complexity assembly rather than technological deepening.

The Shift to IC Design & Fabrication: The “Make in Vietnam” Pivot

To bridge the value gap, the sector has activated a dual-track champion strategy targeting distinct strategic mandates. The commercial engine is driven by FPT, which utilizes a “Fabless” model to target high-volume PMIC and IoT markets ($1.3T TAM); by retaining design IP while outsourcing fabrication, FPT serves as the primary commercial vehicle to anchor the national goal of 50,000 engineers by 2030. Simultaneously, Viettel is executing the state’s “Hardware Autonomy” mandate through the January 2026 groundbreaking of Vietnam’s first fabrication plant. Focused on mature nodes (32nm+) for defense and critical infrastructure, this facility—validated by the proprietary 5G DFE Chip—marks the structural transition from simple assembly to sovereign IP mastery.

Confronting the Systemic Barriers to Scalability in Power and People

While the growth story is compelling, the operational reality in Vietnam involves significant risks that must be priced into any investment model.

Energy Security: The “Make or Break” Variable

For hyperscale investors, power is no longer just an operational expense; it is the primary “Go/No-Go” gate. The narrative has shifted from simple availability to bankability. The rolling blackouts of mid-2023 in Northern Vietnam served as a structural wake-up call, disrupting operations for giants like Foxconn and costing the economy an estimated $1.4 billion. For a Tier III Data Center requiring 99.982% uptime, the national grid’s reserve margin has emerged as the single biggest point of failure, forcing site selection strategies to prioritize zones with direct industrial power feeds over pure cost advantages.

Human Capital: The Structural Rate Limiter

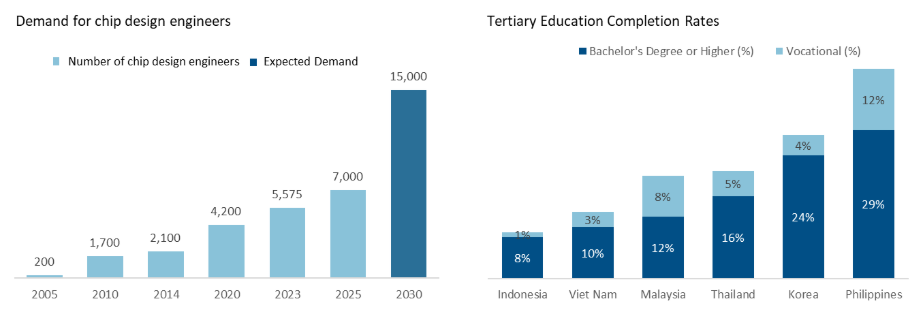

Figure 3: The “Talent Cliff”: Widening Supply-Demand Gaps Amidst Regional Education Deficits (WorldBank, 2025)

While “China+1” secures financial capital, the scarcity of human capital dictates the speed of deployment. The verified baseline reveals a stark reality: Vietnam currently possesses a core workforce of over 7,000 integrated circuit (IC) design engineers. In 2025 alone, the market added nearly 1,000 engineers, yet this growth was achieved primarily by upskilling talent from adjacent technical fields rather than through organic university output. This reliance on lateral hiring exposes the critical bottleneck facing the sector: scaling is currently capped not by student interest, but by a severe shortage of laboratory capacity and qualified lecturers to train the next generation.

The Buy-versus-Build Calculus for Capital Deployment in the 2026 Cycle

The 2026 investment landscape offers a stark choice between M&A for speed and greenfield development for scale. Driven by the removal of Foreign Ownership Limits, M&A has become the strategic imperative for rapid market entry, with foreign funds prioritizing the acquisition of operating assets to bypass the prohibitive 24-to-36-month licensing lag. In this supply-constrained environment, the premium paid for established infrastructure is essentially the price of “time-to-market” certainty. Conversely, greenfield opportunities have migrated to satellite zones like Binh Duong and Dong Nai, where patient capital can deploy “Build-to-Suit” mega-campuses designed for high-density AI workloads from day one, avoiding the costly technical retrofitting required for legacy urban sites.

Vietnam’s digital infrastructure cycle has entered its deal phase.

From hyperscale data centers to semiconductor platforms, Dealflow.sg advises buyers and sellers on sourcing and executing control transactions in Vietnam. Discover active deals and sector insights at Dealflow.sg.