Vietnam is not one market – it is two. Misjudging the North-South divide can cost millions in logistics and labor inefficiencies. This guide analyzes the critical trade-offs between Northern supply depth and Southern export agility to secure your competitive edge.

Navigating Vietnam’s Industrial Dualism

For global supply chain leaders, the “China Plus One” strategy has evolved from risk mitigation to operational necessity, with Vietnam emerging as the primary beneficiary. Yet, treating Vietnam as a monolithic market is a strategic error. The country operates as a dual economy, presenting investors with two distinct industrial ecosystems rather than a single unified location.

The NKEZ, anchored by Hanoi and Hai Phong, functions as a seamless extension of the Southern China supply chain, dominating in electronics and heavy industry. In contrast, the SKEZ, centered on Ho Chi Minh City, serves as the nation’s diversified commercial engine, optimized for global exports and mixed manufacturing. Site selection is thus not merely a geographical choice, but a fundamental trade-off between upstream supply depth and downstream export agility.

The Industrial Landscape: Northern Velocity vs. Southern Resilience

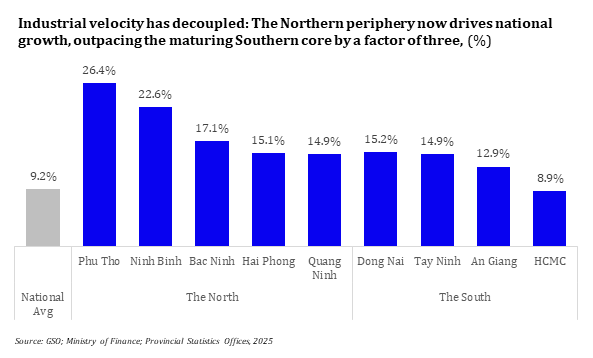

While Vietnam recorded a six-year high Index of Industrial Production (IIP) growth rate of 9.2% in 2025, the aggregate data masks a sharp regional bifurcation in growth drivers.

Figure 1: 2025 IIP Growth by Key Province vs. National Average

The Industrial Landscape: Northern Velocity vs. Southern Resilience

Regional momentum has bifurcated into two distinct structural shifts. The North is defined by Tier 2 Velocity, where manufacturers are leapfrogging the saturated core for peripheral hubs like Phu Tho (+26.4%) to secure labor arbitrage without sacrificing the critical supply tether to China. Conversely, the South is defined by Structural Maturity, pivoting from volume to resilience; as HCMC sheds low-value assembly to gateway provinces like Tay Ninh (+14.9%), the region has cemented a critical energy security advantage over the volatile North through the commissioning of major power infrastructure in Dong Nai.

FDI Inflows and Investor Profiles: The DNA of Capital

The divergent industrial data reflect the distinct “industrial culture” and capital flow of each region:

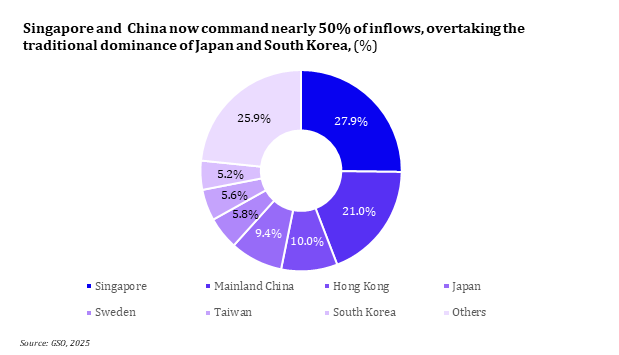

Figure 2: 2025 Newly Registered FDI Capital by Country

Regional capital flows reveal distinct strategic mandates. The North is defined by the “East Asian Axis” (South Korea, Taiwan, China), where $5.5 billion in new capital is being deployed to construct a seamless component ecosystem. Chinese investors are aggressively treating provinces like Quang Ninh and Bac Giang as logistical extensions of their Southern China headquarters to secure supply chain continuity. Conversely, the South retains a cosmopolitan profile of Western and Asian capital that prioritizes stability over speed. Major commitments from giants like LEGO and PepsiCo confirm the region’s successful pivot to “Green Manufacturing,” attracting investors who value carbon-neutral infrastructure and mature export logistics over low-cost assembly.

Industrial Clusters: Comparing North vs. South Vietnam Ecosystems

In Vietnam, investors do not merely rent land; they plug into specialized ecosystems. The choice is binary: specialized depth in the North versus diversified breadth in the South.

The North: Electronics & High-Tech Cluster (“The Silicon Delta”)

The Red River Delta has evolved into the “Silicon Delta” of Southeast Asia, defined by a rigid “Queen Bee” structure:

- The Samsung Gravity: Producing ~50% of its global phones here, Samsung enforces a rigid 40km supplier radius around Bac Ninh to satisfy critical “Just-in-Time” (<4 hours) delivery windows.

- The Apple Corridor: Assemblers like Foxconn and Luxshare have colonized Bac Giang to exploit the <24-hour trucking link to Shenzhen, creating a seamless component tether that the South cannot replicate.

- The Value Shift (Semiconductors): The region has graduated from simple assembly to high-value testing and packaging (OSAT), anchored by Amkor’s $1.6B mega-facility and Hana Micron’s expansion.

The South: Diversified Manufacturing & Commercial Hub

The South operates as a diversified engine, winning projects based on consumption, logistics, and sustainability:

- The Consumption Play (FMCG): Concentrating 40-50% of national purchasing power, the region anchors FMCG giants like Suntory PepsiCo ($300M), securing critical proximity to both the consumer base and Mekong agricultural inputs.

- The Export Backbone (Furniture & Footwear): Binh Duong and Dong Nai remain the R&D and logistics hubs for the Nike/Adidas ecosystem. While assembly shifts to Tier 2, the core functions stay anchored here to leverage Cai Mep Port for direct deep-sea access to Western markets.

- The Green Advantage: The South is winning ESG-driven FDI on Carbon Neutrality, not cost. LEGO’s $1.3B net-zero factory confirms the region’s superior renewable infrastructure is now the decisive factor for global manufacturers.

Supply Chain Architecture: Vertical Depth vs. Horizontal Breadth

The structural maturity of the supply chain varies fundamentally by region, dictating the ease of localization.

- Northern Depth (Vertical Specialization): Offers unrivaled depth in electronics but suffers from “Capacity Lock-in.” Existing Tier 1 vendors are frequently monopolized by anchor tenants (Samsung, LG), often forcing new entrants to rely on Chinese imports until local capacity can be secured.

- Southern Breadth (Horizontal Versatility): Provides superior operational resilience through a vast, accessible network of general industrial services (packaging, molding, maintenance). This redundancy ensures that unlike the North, backup vendors are readily available for general manufacturers.

Comparative Economics: The Erosion of Arbitrage

The historic cost advantage of Northern Vietnam is eroding under the weight of its own success. For investors in 2026, the economic calculus has shifted from a simple price comparison to a trade-off between Northern Availability and Southern Stability.

Industrial Land: The Scarcity Premium

As of Q1 2026, the North-South dynamic has shifted from price arbitrage to capacity arbitrage. The South remains the premium incumbent with lease rates averaging $175–$191/m², but it has hit a hard ceiling; with Tier 1 occupancy exceeding 90%, the market is effectively “sold out” for large entrants, forcing capital into peripheral gateways like Long An. Conversely, the North is no longer “cheap,” but it is available. Despite 4.2% price growth narrowing the gap, the region’s defining advantage is absorption capacity; having brought 400+ hectares to market in 2025 – double the South’s volume – the North stands as the only viable option for mega-projects requiring large, contiguous land banks.

| Region | Key Hub | Avg. Rent ($/m²/term) | Strategic Fit |

| NORTH | Bac Ninh | $160 – $180 | High-Tech Ecosystem: Best for Samsung/Apple suppliers. |

| Hai Phong | $130 – $150 | Logistics Heavy: Best for export-oriented heavy industry. | |

| Phu Tho | $80 – $100 | Cost Leader: The new alternative for labor-intensive assembly. | |

| SOUTH | HCMC | $280 – $300 | HQ & R&D: Too expensive for manufacturing; ideal for labs/offices. |

| Binh Duong | $175 – $200 | Mature Hub: Best for mixed manufacturing requiring skilled ecosystem. | |

| Long An | $160 – $190 | Southern Gateway: The primary overflow valve for the South. |

Table 1: Strategic Land Indicators

The Labor Market: Skill Access Over Cost Savings

The narrative of “cheap labor” is obsolete; the strategic focus has shifted entirely to skill access. With the 2026 regulatory hike and fierce competition from electronics giants, the historical “Northern Discount” has evaporated, driving factory wages to near-parity with the South at ~$300-$350/month. Consequently, regional differentiation now hinges on management depth: the South commands a 15-20% premium for senior roles, a cost justified by immediate access to a mature, English-proficient workforce that the North is still developing.

Infrastructure & Logistics: The Connectivity Divide

Logistics dictates the site selection strategy: The North is optimized for cross-border integration (Speed), while the South is built for global maritime access (Volume).

Northern Logistics: The China Land Bridge

The North’s logistical supremacy is anchored in its physical connectivity to the “world’s factory.” With the completion of the expressway network to the border in late 2025, the region now operates as a seamless extension of the Greater Bay Area.

- The “Rolling Warehouse” (Trucking): The decisive advantage. Completed expressways allow 12-24 hour trucking from Shenzhen to Bac Ninh. This enables a “Just-in-Time” supply chain with Chinese component suppliers that the South cannot replicate.

- Gateway Status: While historically reliant on transshipment, Hai Phong’s Lach Huyen Port now handles mother vessels (160k DWT), reducing reliance on Singapore. However, direct frequency to Western markets still lags behind the South.

Southern Logistics: The Global Maritime Gateway

- Deep-Sea Supremacy (CMTV): The South’s Cai Mep – Thi Vai port offers the highest frequency of direct deep-sea services to the US West Coast and Europe. For volume-heavy sectors (furniture, footwear), this direct access is non-negotiable to maintain margins.

- The Congestion Tax: Internal connectivity is the region’s weakness. Chronic gridlock at the older Cat Lai Port (HCMC) and surrounding ring roads often forces delays, pushing smart investors to bypass HCMC entirely and locate closer to the deep-sea terminals in Ba Ria – Vung Tau.

| Mode | Route | Transit Time | Cost (40′ FCL / kg) | Strategic Fit |

| Trucking | Shenzhen -> Bac Ninh (North) | 1-2 Days | Moderate | Best for: JIT Electronics components. |

| Sea Freight | Shenzhen -> Hai Phong (North) | 3-5 Days | ~$330 | Best for: Heavy Machinery, Bulk Inputs. |

| Sea Freight | Shenzhen -> HCMC (South) | 3-5 Days | ~$300 | Best for: General Inputs, Non-urgent stock. |

| Air Freight | Shenzhen -> Hanoi/HCMC | 1-2 Days | ~$1.40/kg | Best for: Urgent Samples, High-Value Chips. |

Table 2: Comparative Logistics Metrics (Shenzhen to Factory)

Operational Risks: Energy Security & Climate

Operational risk profiles diverge sharply. The North faces a “double whammy” of volatility: a power grid exposed to drought-induced curtailment and the “Nom” season’s saturation humidity, which forces heavy CAPEX on dehumidification. Conversely, the South offers manageability: a stable thermal profile and superior solar potential. Its only major risk – tidal flooding – is predictable and easily mitigated by standard site elevation, avoiding the active crisis management required in the Red River Delta.

The Strategic Divergence

The choice between Northern and Southern Vietnam is no longer a calculation of “better” or “worse,” but a strategic alignment of operational DNA. The 2026 data reveals a clear divergence: The North has optimized for Supply Chain Velocity, while the South has optimized for Commercial Resilience.

The Decision Matrix

Investors should map their operational imperatives against these two distinct profiles:

Select The North (NKEZ) If:

- The “China Link” is Critical: Your Bill of Materials relies heavily (>40%) on Chinese components. The 12-hour trucking window from Shenzhen is an unbeatable inventory advantage.

- Vertical Depth: You require the specialized ecosystem of the “Samsung/Apple Cluster” (precision molding, die-casting, electronics).

- Scale Priority: You are a mega-project requiring large contiguous land banks (>20ha) and rapid administrative setup (e.g., Hai Phong, Quang Ninh).

- Risk Profile: You have the CAPEX budget to mitigate grid volatility and install humidity controls.

Select The South (SKEZ) If:

- Global Export Focus: Your primary markets are the US or EU. The direct deep-sea connectivity of Cai Mep – Thi Vai provides the fastest, most cost-efficient route to the West.

- Sustainability Mandate: You have strict Net Zero targets. The South’s superior solar irradiance and green industrial parks (VSIP III) offer a faster path to carbon neutrality.

- Talent Dependency: You rely on top-tier expatriate management or R&D leads who demand the cosmopolitan lifestyle and amenities of Ho Chi Minh City.

- Diversified Sourcing: Your supply chain is global or localized, reducing the need for the immediate Chinese land border link.

Strategic Outlook 2026-2030: The Pivot from Cost to Connectivity

Looking ahead, the era of simple “Cost Arbitrage” in Vietnam is effectively concluding. As wage gaps narrow and Tier 1 land prices reach regional peaks, the primary driver of competitive advantage has shifted from cost minimization to logistical connectivity.

The next cycle of FDI winners will be defined by the “Tier 1.5” strategy – the deliberate selection of locations in the immediate expressway shadow of major hubs, such as Phu Tho in the North or Long An in the South.

This approach allows investors to capture the remaining pockets of labor arbitrage without sacrificing the logistics velocity required by modern supply chains. Ultimately, the market has reached a strategic bifurcation: the North stands as the engine of efficiency for the Asia-centric manufacturer integrating with regional networks, while the South remains the anchor of resilience for the global exporter seeking stability and sustainability.

Vietnam’s industrial landscape is not unified — it is structurally dual.

From Northern supply-chain velocity to Southern export resilience, Dealflow.sg advises corporates and investors on navigating site selection, restructuring, and control transactions across Vietnam’s industrial ecosystems. Explore active mandates and regional insights at Dealflow.sg.