From tax haven to manufacturing hub: How the 2026 “Negative List” and 30% processing rule create a structural cost advantage for ASEAN exporters entering the Chinese market.

Hainan as the Asia-Pacific “Super-Connector”

As of January 2026, the global trade architecture in the Asia-Pacific has shifted fundamentally. With the official launch of island-wide special customs operations on December 18, 2025, Hainan has transitioned from a pilot zone to a fully distinct customs territory, effectively becoming China’s largest “offshore” economic engine. For international investors and ASEAN supply chain directors, this event – known domestically as fengguan – signifies that Hainan is no longer merely a tax haven but a manufacturing arbitrage platform.

The strategic implication for investors lies in the structural arbitrage created by the new customs regime. The expansion of the zero-tariff list to cover 74% of imports and the operationalization of the 30% Value-Added Processing Rule have created a legal mechanism to bypass mainland China’s external tariff wall. Furthermore, the China-ASEAN Free Trade Area (CAFTA) 3.0 Upgrade Protocol, signed in October 2025, positions Hainan as the physical testing ground for new digital and green economy standards, solidifying its role as the “Super-Connector” between ASEAN resource markets and Chinese consumer demand.

Four Pillars of Structural Advantage in the 2026 Framework

While the regulatory framework is complex, the investment logic rests on four undeniable operational advantages.

- Tariff Scope Expansion (21% → 74%): The zero-tariff list has jumped from ~1,900 to over 6,600 categories. By eliminating duties on critical inputs and capital equipment, this shift effectively lowers the operational expenditure (OpEx) baseline by approximately 20% compared to mainland facilities.

- The “Origins” Arbitrage (30% Value-Added Rule): This policy serves as a fiscal backdoor to the Chinese market. Goods processed in Hainan with at least 30% added value bypass mainland import tariffs entirely. This allows ASEAN manufacturers to import duty-free materials, process them locally, and distribute to China with domestic-level competitiveness.

- The “Double 15” Tax Advantage: Hainan’s fiscal regime now undercuts traditional hubs. Corporate Income Tax (CIT) is capped at 15% (vs. 25% mainland / 16.5% Hong Kong) for qualified operations. Similarly, Personal Income Tax (PIT) is capped at 15% for talent, providing a critical retention tool against the mainland’s 45% top marginal rate.

- Removal of Non-Tariff Barriers: New “Second Line” protocols have eliminated import licensing for most mechanical and electrical goods. This deregulation replaces administrative friction with automatic licensing, compressing logistics cycles to support “Just-in-Time” manufacturing.

Unlocking the “30% Value-Added” Arbitrage Mechanism

The investment case for Hainan in 2026 rests on the interplay between the Negative List, which lowers entry costs, and the 30% Value-Added Processing Rule, which protects exit margins. This rule is the FTP’s primary instrument of industrial policy, allowing goods produced in Hainan using imported, duty-free materials to be sold to mainland China exempt from import tariffs, provided the processing generates at least 30% added value.

This policy creates a “Tariff Inversion” opportunity for high-volume, low-margin industries. In a traditional model, a manufacturer importing raw materials to Shanghai would pay a 10% import tariff and 13% VAT before processing. Under the Hainan model, the manufacturer imports raw materials to Hainan at 0% tariff, processes the goods to achieve the 30% value-add threshold, and then sells to the mainland at 0% tariff. This effectively saves the initial import duty, creating a permanent gross margin advantage.

The value-added content of goods is calculated using the following formula:

Value-Added % = [(Domestic Sales Price − ∑ Cost of Imported Materials − ∑ Cost of Domestic Materials) ÷ (∑ Cost of Imported Materials + ∑ Cost of Domestic Materials)] × 100%

While the framework applies broadly, seven high-value sectors show the strongest immediate potential for arbitrage under the 2026 regime.

| Industry Vertical | Value-Add Activity | Fiscal & Operational Advantage |

| Biopharma & MedTech | Conversion of imported APIs and reagents into finished drugs, vaccines, or diagnostic kits. | Duty-free access to innovative R&D equipment and raw materials. |

| Food & Agri-Processing | Deep processing and branding of tropical ingredients for the mainland consumer market. | Tariff exemptions on processing machinery and imported premium raw materials. |

| Advanced Equipment (Marine/Aero) | System integration, testing, and final assembly utilizing imported precision components. | Duty-free importation of key parts and marine resource development equipment. |

| New Energy (NEV) & Batteries | Module assembly, battery pack integration, and vehicle finishing using global materials. | Tariff exemptions on essential electronic and chemical components. |

| Electronics & Smart Hardware | Final assembly, software integration, testing, and certification of imported parts. | Duty-free entry for computing equipment and electronic sub-components. |

| MRO Services (Yachts/Aircraft) | High-value technical maintenance, refurbishment, and engineering modifications. | Tariff exemptions on imported repair parts and transportation equipment. |

| Luxury & Jewelry* | Design, cutting, setting, and finishing of precious metals and gemstones. | Bonded Zone Exemption: Duty-free status for raw materials within specific zones. |

Table 1: Key Industry Verticals Benefiting from the 2026 Zero-Tariff Regime

Accelerating Trade Velocity & Ecosystem Density

The 2026 customs closure is not a cold start; it is an accelerant applied to an already exploding engine. Historically a fiscal backwater with a per capita GDP just one-third of Beijing’s, Hainan has successfully leveraged early policy pilots to generate structural trade velocity.

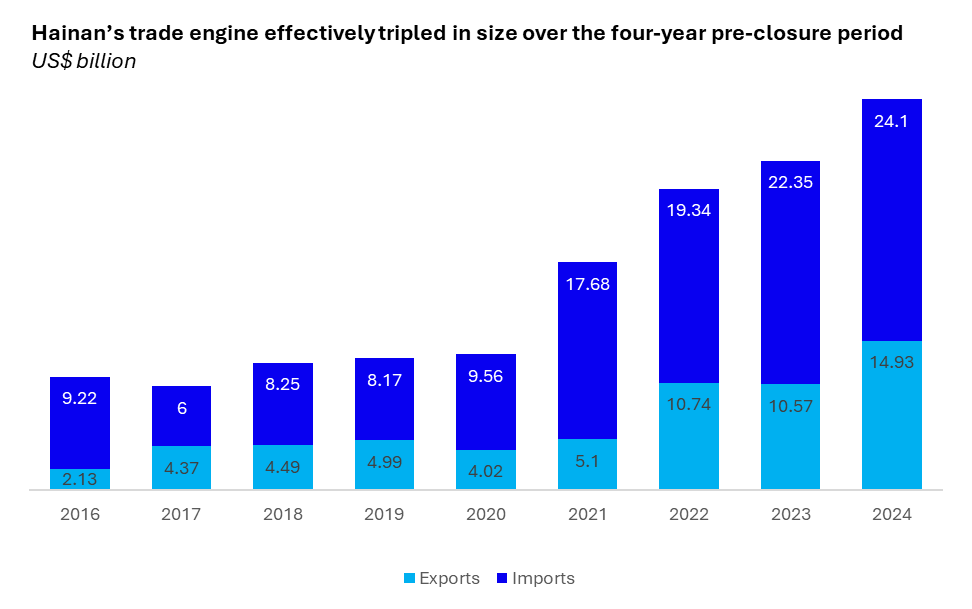

The “Proof of Concept” (2020–2024) Data from the pre-closure period validates the efficacy of the FTP model. Between 2020 and 2024, Hainan’s total two-way trade nearly tripled in nominal terms – surging from $13.58 billion to $39.03 billion. This trajectory represents a blistering Compound Annual Growth Rate (CAGR) of 30.2%, a figure that far outpaces national averages and signals a definitive decoupling from legacy economic constraints.

Figure 1: Growth in Hainan’s Foreign Trade (Source: China Briefing, 2025)

Key Performance Indicators (KPIs):

- Ecosystem Density: By the end of 2024, the number of registered foreign trade companies exceeded 74,000 – a 19.8-fold increase since 2018.

- Import Gravity: Driven by early zero-tariff pilots, imports hit a record $24.13 billion in 2024, confirming the island’s appetite for global inputs.

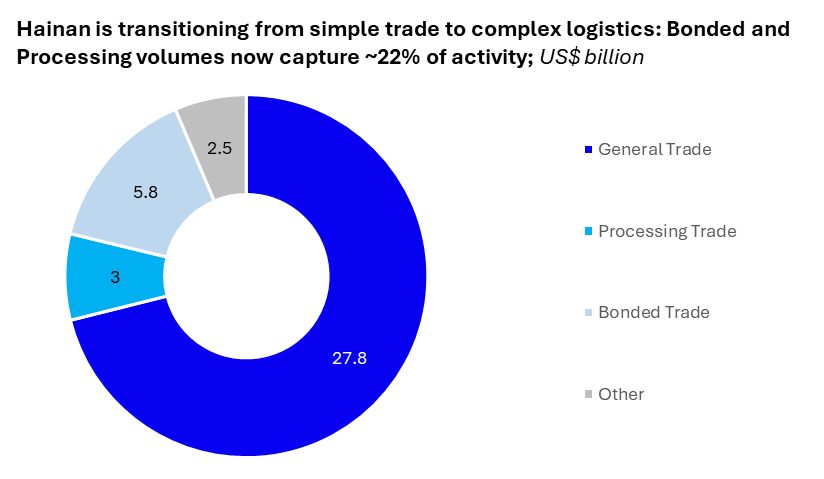

- Manufacturing Readiness: Crucially, “Processing Trade” grew 26.5% year-on-year in 2024. While still a developing segment (<8% share), this double-digit velocity confirms that investors began positioning for the “30% Value-Added” arbitrage well before the 2026 island-wide rollout.

Figure 2: Breakdown of Haian’s Foreign Trade, 2024 (Source: China Briefing, 2025)

Industrializing Food Processing & Tropical Agriculture

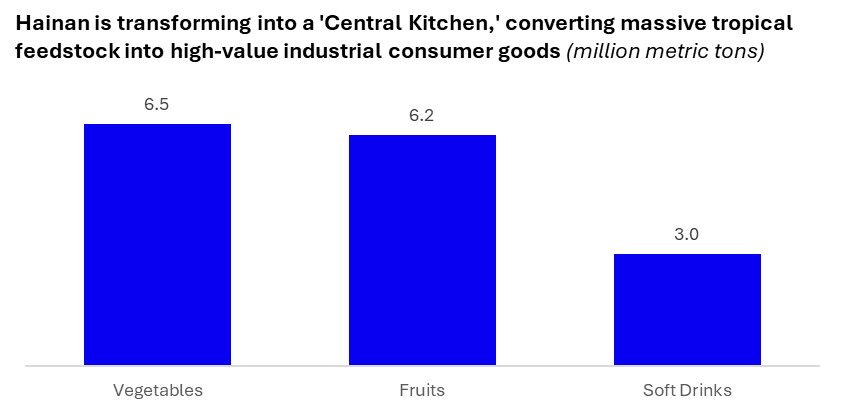

The island’s strategic value lies in its hybrid supply chain model, which combines a massive domestic feedstock base with duty-free global inputs. Hainan’s agricultural foundation is robust, with plantation output reaching RMB 142 billion ($20.1 billion) in 2024, underpinned by 6.2 million tons of tropical fruit and 6.5 million tons of vegetables. However, the real investment story is the rapid shift from simple cultivation to high-value industrialization.

The data confirms a distinct inflection point driven by the new customs regime. As manufacturers leveraged zero-tariff access to imported inputs (such as grains, edible oils, and sugar) to complement local resources, the sector’s industrial velocity exploded. Value-added output for food processing surged 22.5% in 2024, before accelerating to a staggering 53.5% year-on-year in the first half of 2025.

This hyper-growth validates the “Central Kitchen” thesis: Hainan is successfully transforming into a critical processing node where global bulk commodities and local tropical resources are converted into high-margin consumer goods (like the 3 million tons of soft drinks produced in 2024) for duty-free distribution to the mainland market.

Figure 3: Major Agricultural & Food Output, 2024 (Source: China Briefing, 2025)

Upgrading Tourism & Modern Services Value Chains

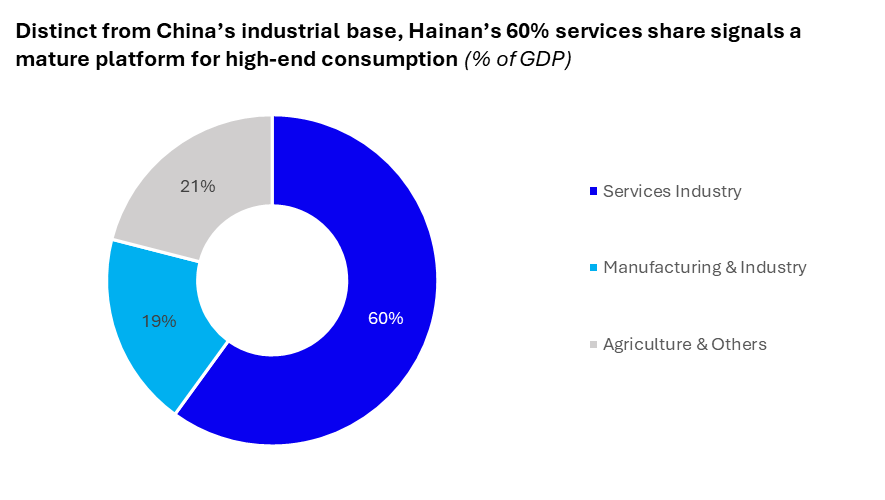

Figure 4: Hainan Economic Structure, 2024 (Source: China Briefing, 2025)

Hainan’s economic engine is distinct from the mainland’s industrial model. In 2024, the services sector drove over 60% of GDP, underpinned by a record 97.2 million visitors and RMB 204 billion ($28.9 billion) in revenue.

The 2026 customs framework is designed to pivot this volume into value. Aligned with the 15th Five-Year Plan (2026–2030), the zero-tariff regime acts as an upgrading lever rather than a simple discount mechanism. By enabling duty-free access to superior imported amenities, medical technologies, and cultural assets, the policy allows operators to structurally elevate the consumption experience.

The market is primitive for this shift. Per capita visitor spending reached RMB 2,099 ($298) in 2024 – the highest national average – validating the demand for high-end niches such as medical tourism, marine leisure, and luxury retail. For investors, the strategic play lies in leveraging “Negative List” imports to service this premium segment, while utilizing the 15% tax cap to protect operating margins.

Second Line Bottlenecks and Global Trade Risks

Despite the structural advantages, the Hainan FTP presents a “High Reward, High Compliance” environment that investors must navigate carefully. The “Second Line” bottleneck remains a primary operational risk. The sheer volume of trade post-closure is testing customs infrastructure, and while “Smart Customs” initiatives aim for 2-3 day clearance times, complex value-add calculations for mixed-origin goods can cause delays. The burden of proof for the 30% rule lies entirely with the enterprise, making robust ERP digital ledgers non-negotiable.

Furthermore, for multinational corporations exporting from Hainan to Western markets, the Uyghur Forced Labor Prevention Act (UFLPA) constitutes a critical compliance risk. The “Zero-Tariff” regime encourages the commingling of global and domestic inputs. Investors must implement rigorous “identity preservation” systems to ensure no supply chain contamination occurs if they plan to re-export products to the United States, as any association with restricted entities could lead to seizure.

Capitalizing on the Structural Realignment of the China-ASEAN Economic Corridor

The launch of island-wide customs operations in December 2025 was not merely a bureaucratic update; it was a structural realignment of the China-ASEAN economic corridor. For ASEAN businesses, Hainan represents a fiscal airlock – a jurisdiction designed to strip out tariff costs, add high-tech value, and access the Chinese consumer market with the competitiveness of a local player.

Whether it is CP Group’s 10 billion yuan bet on food security or Nippon Paint’s pivot to green marine technology, the smart money is moving from “trading with China” to “processing in Hainan.” Manufacturers currently serving China from ASEAN factories should conduct a detailed cost-benefit analysis of moving final assembly stages to Hainan, as the 30% rule often outweighs the incremental cost of relocation. With the “Cross-Border Data Negative List” rolling out in Q1 2026, the window to establish early leadership in this new ecosystem is open now.

Hainan’s 2026 customs closure marks a structural reset in the China–ASEAN trade corridor.

As the Negative List lowers entry costs and the 30% Value-Added Rule protects exit margins, investors must shift from viewing Hainan as a tax incentive to treating it as a manufacturing arbitrage platform. Dealflow.sg supports investors and operators in structuring, diligencing, and executing ASEAN–China supply chain strategies through Hainan’s evolving FTP framework.

Explore active mandates and market intelligence at Dealflow.sg