What makes the Vietnam real estate market trends worth watching in 2026? Strong demand, rising foreign investment, and major shifts across housing, retail, and industry are changing the game. New laws open doors for international buyers. Big projects from global developers are taking shape. This article breaks down key market drivers, forecasts, legal updates, and investment insights—all in one place. Stay informed with the latest Vietnam property market outlook with Dealflow before making your next move.

Vietnam Real Estate Market Overview 2025–2026

Vietnam real estate market 2025 – 2026

According to the International Monetary Fund, Vietnam’s economy grows at around 7.09% in 2024, slows to about 5.8% in 2025, then to near 4.0% in 2026. Strong growth in the years before 2025 fuels housing, retail, logistics, and office space.

Foreign direct investment jumped in early 2025, up about 46% year on year, reaching nearly $2.4 billion just in real estate deals. Home prices rise fast in major cities. Based on JLL’s report, apartment prices in Hanoi climb nearly 30% year on year by Q1 2025 to about $2,865 per sq m. The real estate market in Vietnam enters a new phase marked by project expansion, legal reform, and infrastructure upgrades.

Major cities saw strong demand. Hanoi and HCMC lead in luxury and mid‑market sales. Some secondary cities (Da Nang and Hai Phong) gain more attention. Commercial and retail segments recover as retail sales reach about $250 billion in 2024, with a 9% gain over 2023.

Key Economic Factors Driving Vietnam’s Property Market Growth

- Strong GDP growth: Above 7% in 2024. It supports rising incomes, demand for housing, and rental space.

- Rising FDI: Foreign capital pours into real estate. Legal reforms raise clarity and confidence.

- Urbanisation: More people move to cities. That connects to demand for modern homes, offices, and logistics hubs.

- Infrastructure build‑out: Rail, roads, and airports expand. New metro and expressways unlock suburbs for development.

- Legal reforms: Changes in land, housing, and foreign ownership laws improve transparency. That invites more US investors.

- E‑commerce boom and consumption: Consumer trend drives retail property. E‑commerce volume exceeded $25 billion in 2024, up 20% year on year.

Vietnam Real Estate Market Size and Investment Forecast to 2026

Invest Vietnam predicts that estimates place the total Vietnamese property sector value at about $47.59 billion in 2025. Mordor Intelligence projects the residential segment alone at $33.19 billion in 2025, rising sharply by 2030.

Commercial real estate reached around $16.6 billion in 2024. Experts of MarketResearch.com forecast it to grow at about 13.8% annually through 2025–2034. Simple extrapolation places it at over $19 billion by the end of 2026.

Foreign investment keeps climbing. Investment in property rose about 46% in Q1 2025. That signals high investor appetite into 2026.

Urban expansion drives mid‑market and affordable housing. Luxury homes also find buyers in expat and wealthy Vietnamese segments. Growth forecast shows steady demand through 2026. Bond and mortgage markets support financing access for buyers. However, credit risk is still an issue. It’s monitored by the central bank in 2025.

Top Real Estate Trends in Vietnam: Residential, Commercial, and Industrial

Vietnam real estate market shows strong growth across the sectors below:

Residential Property Demand and Housing Prices in Vietnam

Housing demand rises sharply in 2023 and 2024. According to JLL Vietnam’s report, Hanoi led the surge with a 29.6% rise in apartment prices to $2,865 per sqm in Q1 2025. Sales jumped 49% year‑on‑year to nearly 7,914 units in Q1 2025.

New condo launches tripled in Hanoi in 2024 to almost 40,000 units. Sales of these homes reached over 70% take-up, with prices growing roughly 24% year‑on‑year. The first quarter of 2025 saw continuing gains, up about 5% from Q4 2024.

In Ho Chi Minh City, fewer residential projects were launched in 2024. Sales of landed properties dropped 50% due to high prices. Yet, new infrastructure such as Metro Line 1 lifted long‑term demand.

Mordor Intelligence reported that the residential market size reached $33.19 billion in 2025. Analysts expect an 11.45% compound annual growth rate from 2025 to 2030.

Growth in Commercial and Retail Real Estate Sectors

Commercial real estate market

According to the National Statistics Office, retail and commercial space rebounded in 2024. Consumer goods and services sales climbed 9.3% in Q4 2024, reaching approximately $250 billion for the full year.

Retail rental rates rose, too. Based on Savills’ report, ground-floor rent in major malls climbed 10% YoY to about VND 1.5 million/sqm/month (about $65) in late 2024.

Commercial market value stood at about $16.61 billion in 2024. Forecasts point to 13.8% annual growth between 2025 and 2034.

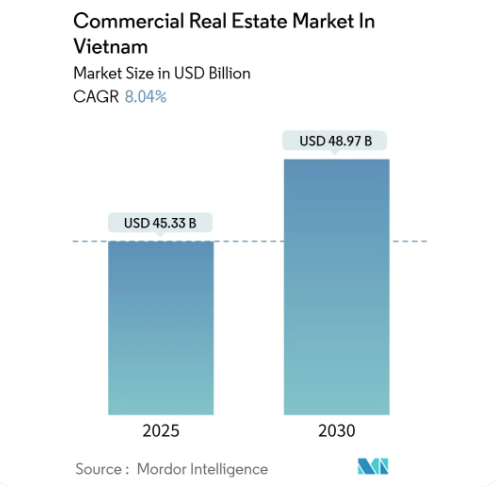

Mordor Intelligence predicts the total commercial real estate market will reach $45.33 billion in 2025. Analysts expect a CAGR of 8.04% through 2030.

Strong demand appears in Class A offices, logistics centers, mixed-use developments, and data‑center campuses. Developers integrate smart systems and green design features to attract tenants.

Vietnam’s Booming Industrial and Logistics Real Estate

Massive growth hits industrial real estate in 2024 and early 2025. The country added 4,750 hectares of industrial land by August 2024, up 5% over 2023. Average industrial park occupancy rose to 75%, up 2.6 percentage points year‑on‑year. Rent climbed to $156 per sqm, up 6%.

Foreign direct investment strengthens the sector. Vietnam attracted $38.23 billion in FDI in 2024. High‑tech firms (Samsung, LG, and Foxconn) drive demand for about 1.2 million sqm of factory space in Ho Chi Minh City and Hanoi.

In Q1 2025, industries kicked off many projects. A new semiconductor plant started in Saigon High‑Tech Park. Developers and investors showed clear confidence in FDI‑driven expansion.

Cushman & Wakefield forecasts strong industrial land growth from 2024 to 2027. They expect 10,600 hectares added in major economic regions. Annual growth may reach 7.5%. Investors focus on high‑tech assets, modern warehouses, and the quality of land‑use rights.

Additional growth arrives in Dong Nai and other industrial hubs. Dong Nai plans a free trade zone near Long Thanh International Airport. That zone covers nearly 9,000 hectares of manufacturing, logistics, trade, and innovation zones.

Shein signed a deal mid‑2025 to lease about 15 hectares of industrial land near Ho Chi Minh City for a massive warehouse. This shows global firms using Vietnam as a logistics hub amid trade tensions and export risks.

Legal and Financial Framework for Foreign Real Estate Investors in Vietnam

Legal and financial framework

Recent reforms and clearer regulations help foreign investors now operate with more certainty in Vietnam’s real estate market.

Vietnam’s Real Estate Laws for Foreigners in 2026

New Land Law (effective Jan 2025) and Housing Law (from Aug 2024) give clearer ownership rights to foreigners. Foreign individuals and organisations can own commercial housing projects.

Property caps remain: up to 30% of apartments per condo building and up to 250 landed houses per ward-level area. Land lease terms go up to 50 years, with possible renewal.

Laws now allow for the resale, gifting, inheritance, and mortgage of such housing. Foreign investors cannot own land directly.

Overseas Vietnamese (with citizenship) get rights equal to locals, including mortgage access under defined conditions.

Persons of Vietnamese origin (without citizenship) have fewer rights. They can only own housing plus land use rights within projects.

Financing Options and Mortgage Trends in Vietnam’s Housing Market

Getting a mortgage from a Vietnamese bank remains hard for foreign individuals. Banks demand legal residency, a work permit, and proof of local income. Most foreigners cannot secure loans locally unless employed and officially recorded in Vietnam.

Typical bank mortgage terms include:

- Loan tenor up to 15 years

- Down payment of at least 20%

- Higher interest than for locals

Some international banks—like HSBC or Standard Chartered—offer loans in Vietnam to eligible foreigners. These loans may include special fixed‐rate plans and longer terms. Interest rates from HSBC start around 4% annual during the fixed period, depending on the chosen scheme.

Banks like UOB and Kasikorn offer home loans with interest rates around 5–5.75% per year. Loan terms reach up to 30 years and may fund up to 80% of the property value. These options apply mainly to Vietnamese citizens but may extend to employed foreigners under strict rules.

For foreign investors, alternative funding paths include:

- Financing via banks in the home country.

- Buying through a foreign-invested company in Vietnam to access corporate loans.

- Partnering with a Vietnamese national to buy in their name.

Corporate structures also allow foreign entities to lease land through a foreign-invested company (FIC) and hold LURs.

Foreign Direct Investment in Vietnam’s Real Estate Sector

FDI in the five months 2025

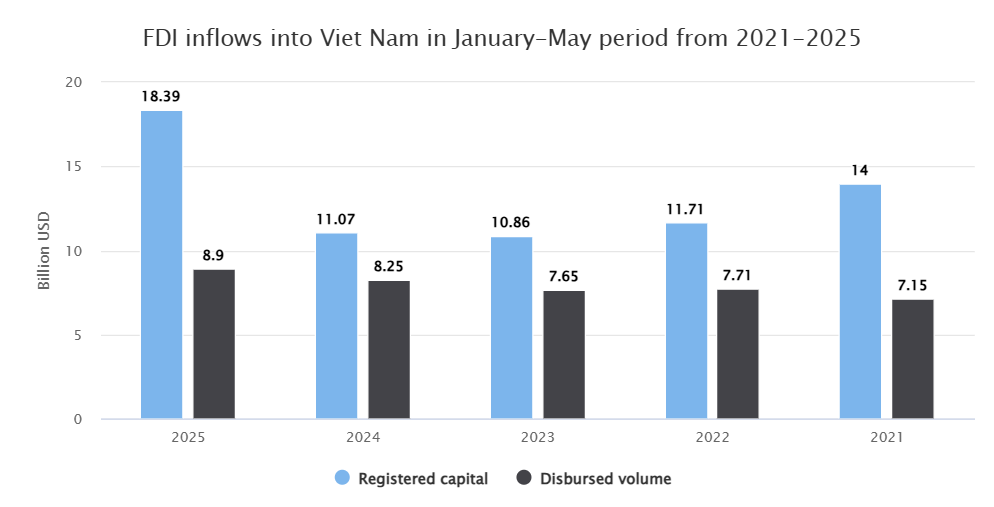

Foreign investment in Vietnam rose sharply in early 2025. The General Statistics Office reported that FDI in the first five months reached $18.39 billion, showing a 51.2% increase year‑on‑year. Real estate accounted for nearly $5 billion, making up about 27% of total inflows, more than double the prior year’s level.

In the first half of 2025, total FDI climbed to $21.5 billion, rising 32.6% from the same period in 2024. Vietnam logged nearly $25.4 billion in foreign direct investment in all of 2024, up 9.4% over 2023, with real estate ranking among the top sectors.

Major investors include Singapore and South Korea. Singapore invested over $4.4 billion in the first five months, while South Korea invested nearly $2.9 billion, both showing strong year‑on‑year gains. Cities such as Hanoi ($3.2 billion) and Ho Chi Minh City ($2.6 billion) led in real estate inflows during early 2025.

Major Foreign Projects and International Developer Activity

Foreign projects

A standout project involves the Trump Organization and Vietnamese partner Kinh Bac City. The government approved a $1.5 billion golf, hotel, and real estate development in northern Vietnam’s Khoai Chau district. Construction began in mid‑2025 and will continue through 2029.

This development spans 990 hectares, and it includes golf courses the size of 336 American football fields, luxury resorts, commercial space, parks, and housing. The Trump Organization also plans a $1 billion high‑rise tower in Ho Chi Minh City. The project is in early planning and awaits approval before construction may begin in 2026.

Other foreign developer activity is increasing. Malaysian group Gamuda Land targets $3.15 billion in revenue in 2025. The company expands land holdings and pushes high‑end housing and modern urban projects in Vietnam.

Japanese‑Vietnamese joint venture BRG Group and Sumitomo Corporation began construction on Phuong Trach Tower—a 108‑storey, $1.55 billion smart‑city centre in Hanoi’s Dong Anh District. Full completion is expected by 2028.

Viva Land and Dong A Bank develop IFC One Saigon in Ho Chi Minh City. This $228 million mixed‑use office, apartment, and retail tower nears completion as international investors continue to back local firms.

Foreign funds also raise Vietnam’s real estate exposure. Vietnam Enterprise Investments Limited (VEIL) increased its real estate holdings to 22% of its portfolio (about $368 million) by May 2025. This reflects confidence in both residential and industrial asset growth.

Developers and investors cite legal clarity and regulatory reform as key drivers. Reforms in 2024–2025 streamlined project approvals and eased foreign investment in housing and land-use rights.

Vietnam Real Estate Market Forecast and Investment Opportunities for 2026

Vietnam real estate market forecast

Vietnam’s property market shows strong momentum in 2025 and prepares for further growth through 2026 and beyond.

Readmore:

* Top Cities in Vietnam for Real Estate Investment in 2025

* Can Foreigners Buy Property in Vietnam? A 2025 Guide

* Industries Attracting the Most M&A Activity in Vietnam

Economic Outlook and Real Estate Recovery

The World Bank Group forecasts Vietnam’s GDP growth to be 6.8 % in 2025, slowing slightly to 6.5 % in 2026. Real estate recovery begins in the second half of 2024 and carries into 2026. Softer global demand introduces risk, but domestic activities remain strong with public infrastructure investment supporting development flows.

Sector Forecasts and Investment Themes

- Residential segment: According to NMSC, the market size reached $89.9 million in 2023 and is expected to grow at roughly 6.4 % annually through 2030. Rising wages and urban population growth fuel ongoing housing demand in major cities.

- Commercial and retail: Expansion continues in 2025. New retail space grows in Ho Chi Minh City, Hanoi, and Da Nang. Rental rates climb with growing e‑commerce and consumer spending.

- Industrial and logistics: Strong interest from foreign manufacturers and global supply chain diversification. Industrial land value and demand grow in key provinces and export zones. Large infrastructure projects, such as the Long Thanh International Airport opening in mid‑2026, open new zones for premium investment and logistics hubs.

Key Opportunities for Investors in 2026

- High-growth zones: Emerging areas like Thu Thiem (Ho Chi Minh City), Vinhomes Smart City (Hanoi), and industrial parks in Dong Nai offer premium project sites.

- Mixed-use and urban renewal: Demand increases for smart-city developments and integrated complexes with residences, retail, and offices. Sustainable projects enjoy strong interest.

- Industrial properties and logistics centers: Manufacturing firms seek modern warehousing and land-use rights inside industrial zones. This segment remains a key driver for FDI and commercial capital.

- Institutional capital: Reallocation from over‑invested property funds and pension portfolios into undervalued assets drives liquidity. According to CBRE, about 46 % of institutional investors plan to boost real estate exposure in 2025–2026.

- Legal and regulatory reform: New housing and land laws in 2024–25 improve transparency. Faster approvals and clearer rules attract foreign capital into real estate and land‑use investments.

Risks to Watch

- Trade uncertainty: Proposed US tariffs on Vietnamese goods (up to 46 %) may slow export-driven growth and weaken investor sentiment

- Credit access: Mortgage rates remain elevated compared to global peers, and foreign buyers still face strict local lending criteria. Delays may constrain transactions.

- Supply imbalance: Overdevelopment in luxury housing may lead to oversupply in the high-end housing market. However, affordable housing is still limited, while it is in demand.

Frequently Asked Questions

1. What are typical rental yields in Vietnam’s property market?

Rental yields in major cities like Hanoi and Ho Chi Minh City average around 3% gross annually. Satellite cities (Binh Duong, Dong Nai) provide higher yields of 4%–4.5%, especially for apartments in affordable zones.

2. Do foreign investors face any legal limits when investing in Vietnam?

According to the Housing Law of 2014, foreign buyers can own up to 30% of the units in a condo building. Decree 99/2015/ND-CP regulates that the ownership of villas or landed houses is capped at 10% per project. All land stays under state control, so foreigners gain only 50-year leasehold rights.

3. What are the best cities to invest in Vietnam real estate in 2026?

Top investment hubs include Ho Chi Minh City, Hanoi, and coastal cities (Da Nang, Nha Trang, and Phu Quoc). These cities appeal to foreign buyers with strong growth potential, urban infrastructure development, and tourism-driven demand.

4. Is Vietnam’s real estate market expected to be stable or risky?

Rising GDP growth above 7% in 2024 and solid reforms support market stability. Regulatory clarity from the new Land and Housing laws in 2024–25 reduces risk. Short-term trade uncertainty (for example, the US tariffs) poses caution in 2025, but the fundamentals are still strong.

5. Are there financing options available to foreign buyers in Vietnam?

Local bank loans are difficult for most foreigners. Banks require residency, a valid work permit, and local income sources. Loan-to-value caps usually range between 50% and 70%. In addition, loan duration often does not exceed 15 years. Foreign investors often use home-country financing, developer installment plans, or set up Vietnamese-incorporated companies to access mortgage facilities.

Closing Words

The Vietnam real estate market trends reveal strong momentum across residential, commercial, and industrial sectors. Foreign investment continues to rise. Improved legal and financial frameworks support it.

Planning to invest in Vietnam’s property market? Now is a smart time to explore new opportunities backed by data, growth, and long-term potential.